Fintech software solutions that are scalable, safe, and intelligent for digital payments, card processing, and

To foster fintech innovation by providing cutting-edge IT infrastructure that streamlines intricate payment processes and fosters confidence via speed, security, and compliance.

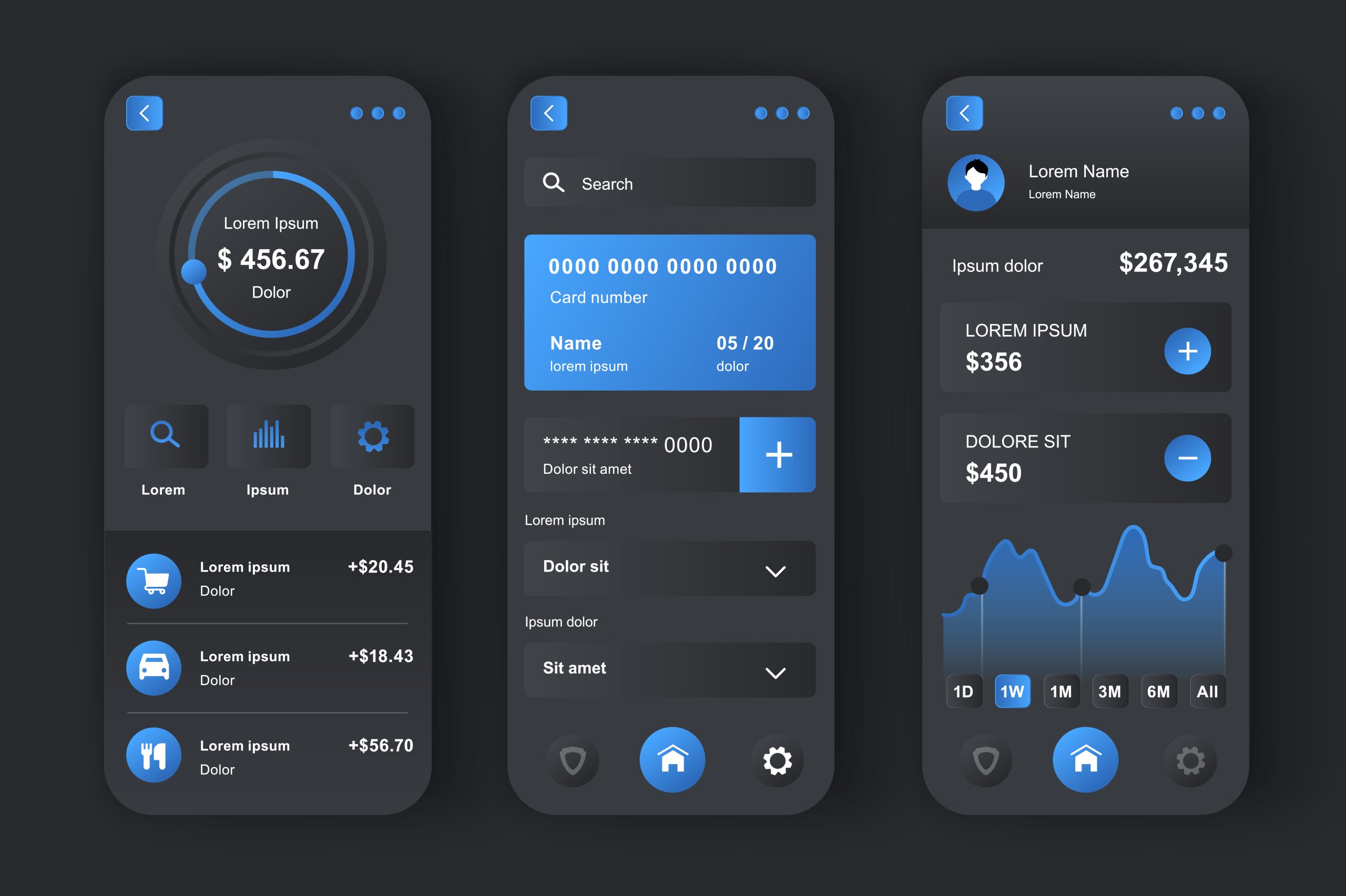

In order to facilitate smooth international transactions, Lovito Services LTD creates scalable, secure payment gateway solutions that manage all aspects of compliance and authorization in a single system.

By managing the whole card lifecycle, from issuance to transaction monitoring and fraud management, Lovito Services LTD enables banks and fintechs to issue and administer debit, credit, and prepaid cards.

The entire payment lifecycle is supported by our modular platform, from transaction processing and settlement to wallet integration and onboarding. We provide a safe, adaptable, and data-driven solution for P2P transfers, QR payments, and recurring billing.

We assist companies in reducing fraud and chargebacks while maintaining adherence to international payment rules. Our technologies use AI to give end-to-end traceability for each transaction, automate reporting, and identify anomalies.

The Payment Card Industry Data Security Standard (PCI-DSS), a widely accepted standard for protecting cardholder data, is closely followed by Lovito Services LTD. To avoid data breaches, fraud, and unauthorized access, our systems are constructed with sophisticated encryption methods, tokenization, and secure key management. Every data touchpoint is safeguarded by a strong compliance structure, from the beginning of transactions to their settlement. This guarantees the utmost honesty and trust in the handling of your clients’ private payment information.

With fault-tolerant architecture and real-time system monitoring, Lovito Services LTD‘s platform guarantees 99.99% uptime. Even during periods of heavy demand, it facilitates uninterrupted, continuous transaction processing thanks to its highly available cloud architecture. Lovito Services LTD maintains your business online and your payments running smoothly with its load balancing, auto-scaling, and quick failover features.

Lovito Services LTD offers extensive integration experience with major regional and international payment networks, such as American Express, Visa, MasterCard, RuPay, and UPI. From onboarding to transaction routing, our platform facilitates end-to-end connectivity, guaranteeing scalability, speed, and compliance. offers smooth compatibility and a quicker time to market across all major railroads, whether you’re allowing domestic payments or entering international markets.

Developer-friendly SDKs and APIs are provided by Lovito Services LTD and are made to integrate quickly and easily into any platform or application. Easily modify card issuance, transaction controls, payment procedures, and reporting tools to meet your company’s requirements. You can design, test, and deploy quickly with our modular architecture without sacrificing performance or security. With the help of our technologies, you can confidently innovate as a fintech startup or organization.

To quickly identify and stop fraud, Lovito Services LTD uses real-time transaction monitoring and sophisticated AI-driven algorithms. Every transaction is evaluated using dynamic risk scoring, which flags questionable activity by analyzing variables like transaction history, behavior patterns, and geolocation. With automated alerts and comprehensive fraud reporting, we help prevent chargebacks and minimize fraud losses. Our proactive approach guarantees that your company may continue to run safely while also providing a positive client experience.

© 2025 Lovito Services LTD. All rights reserved.

© 2025 COMPANY3. All rights reserved.